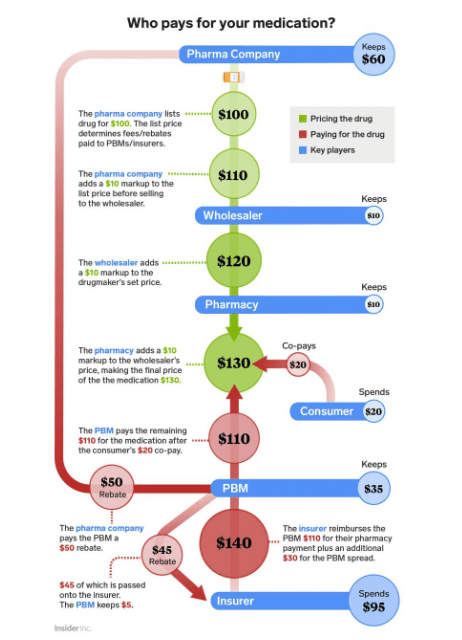

This 2018 diagram via Insider Inc. illustrates the cost and rebate structure of an imaginary drug with a list price of $100, on a commercial plan covering all but a $20 co-pay.

The basic purpose of this diagram is to understand the drug and dollar flow in the US pharma industry.

Below, I am providing a simplified version which you can remember:

I also want to throw some light on below terminologies:

WAC – Wholesale Acquisition Cost

•WAC is the manufacturer’s list price to wholesalers or direct purchasers, excluding discounts and rebates.

•It is used for reimbursements, provider pricing and as a reference in healthcare contracts.

Rebate –

A rebate is a post-purchase discount or refund. In the pharmaceutical industry, a drug manufacturer provides a rebate to a PBM or health plan after a drug has been purchased and dispensed. PBMs negotiate these rebates with manufacturers in exchange for placing their drugs on a preferred list (a formulary).

PBM Spread

GPO – Group Purchasing Organization

•GPOs negotiate contracts and purchase healthcare products for member providers (e.g., hospitals, clinics).

•They pool purchasing volumes to get better prices from suppliers.

•They help members reduce procurement costs and streamline supply chains.

Wholesaler

The top pharmaceutical wholesalers in the U.S. are the “Big Three”:

McKesson Corporation, Cardinal Health, and Cencora (formerly AmerisourceBergen). These three companies control over 90% of the U.S. drug distribution market, acting as a dominant oligopoly in the supply chain.

PBMs – Pharmacy Benefit Managers

For 2024, nearly 80% of all equivalent prescription claims were processed by three familiar companies:

- the CVS Caremark business of CVS Health,

- the Express Scripts business of Cigna, and

- the Optum Rx business of UnitedHealth Group.

Leave a comment